Hello David! I have noticed that formula for both expected loss and CVA is the same. CVA is the present value of future exposure. Isn't expected loss the same thing? I am aware that EL is used for both credit risk and counterparty credit risk. So, why CVA if we can measure CCR with EL? Would be great if you could shine a light on the same.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Valuation Adjustment vs Expected Loss

- Thread starter Sameera

- Start date

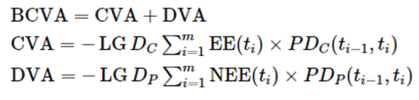

Hi @Sameera Yes, I agree with you, and I this it's easiest to understand CVA as an EL designed for the bilateral context. For example, as I wrote here https://forum.bionicturtle.com/threads/credit-var-vs-cva.9563 i.e.,

... and then mathematically here at https://forum.bionicturtle.com/thre...-value-adjustment-cva-gregory.7826/post-44152 i.e.,

I would start with this: the credit value adjustment (CVA), because it assigns a price to counterparty risk, is essentially an estimate of expected (future) losses, while credit value at risk (CVaR) is an estimate of (future) potential unexpected losses (UL). At the risk of brutal and indefensible simplification: CVA --> EL and CVaR --> UL.

... and then mathematically here at https://forum.bionicturtle.com/thre...-value-adjustment-cva-gregory.7826/post-44152 i.e.,

Thanks!CVA is the price of (credit) counterparty risk, so its (abstracted) formula is similar to expected loss (EL) = PD*EAD*LGD; i.e., CVA ~= PD(Δt)*EE(Δt) *LGD. Whereas EL is the price of default risk in a "unilateral" long bond position (by which I mean, the lender is funding the loan so the lender has unilateral exposure) to a bond, CVA is similarly the price of default risk for a bilateral derivative position. Standalone CVA simply refers to this credit risk price (ie, CVA) for a single trade or position. Both marginal and incremental CVA only have meaning when the position becomes a component in a larger "portfolio," where the portfolio is the netting-set of trades under a netting agreement. Netting allows for the "diversification benefit" which, in this context, is the ability to reduce the netting-set's total price of counterparty risk (aka, CVA).

enjofaes

Active Member

Hi David, just a question on the notation. I've noticed in the videos that EE and NEE was referenced for CVA and DVA respectively. But in the study notes I observe EPE and ENE. Made me a bit confused, perhaps I'm overcomplicating things. But EPE is the weighted average of the EE, with EE the average of the positive instances. EPE however here has a subscript so I guess this is an average that also changes with new transaction over time.

In the GARP books also the notation of the study notes is used. Could you perhaps provide me with some clarity?

In the GARP books also the notation of the study notes is used. Could you perhaps provide me with some clarity?

@enjofaes when doing bilateral valuation of counterparty credit risk. Insertion of DVA will increase the value of the risky position. Also, DVA has funding benefit. by defining defining lets see how we find the relationship:

I understand the pain dealing with curriculum, especially when it comes to notations, this area is summarised and simplified well with BT notes, besides having notations consistent. If i were you I'd first read BT, get an understanding, then refer curriculum for more details

- EE and NEE are used to calculate CVA and DVA.

- CVA is a prediction of loss from credit risk and uses EE.

- DVA is an adjustment to value due to issuer credit risk and uses NEE that also counts current exposure and future cash flows.

- CVA uses EE and DVA uses NEE.

I understand the pain dealing with curriculum, especially when it comes to notations, this area is summarised and simplified well with BT notes, besides having notations consistent. If i were you I'd first read BT, get an understanding, then refer curriculum for more details

enjofaes

Active Member

Hi @gsarm1987 thanks for the message, but how is this related to the notation differences between EE & EPE vs NEE & ENE?

@enjofaesHi @gsarm1987 thanks for the message, but how is this related to the notation differences between EE & EPE vs NEE & ENE?

Book says ENE = expected negative exposure, notes say NEE (Negative expected exposure) , interestingly Wiley also uses NEE.

See page 252 of the book you will see it says "sometimes known as negative expected exposure (NEE)

NEE (Negative Expected Exposure) & EE (Expected exposure). they are used in a bilateral context, implying its not just the borrower who could default, lender may default as well. As you know VAs are assumed on the exposure, in bilateral we are looking at two exposures (i.e. positive and negative exposure) separately and then netting the xVAs (valuation allowances), just giving a background.

EE is expected exposure (no netting just the exposure to the borrower, so always positive)

EPE is Expected Positive Exposure, found as the Weighted av of EEs, its also called Loan equivalent.

In the end, too many of these Exposures to remember, the xVA challenge reading quite nicely puts them all in purpose.

BCVA spread =−EPE×Spreadc−ENE×Spreadp

c is counterparty (they/them/he/she) and p is the party (us/we/me/I) (used pronouns on a lighter note

)

) |

Last edited:

Similar threads

- Replies

- 0

- Views

- 709

- Replies

- 0

- Views

- 1K

- Replies

- 0

- Views

- 2K