rahul.goyl

Member

Hi David,

Please help on the below

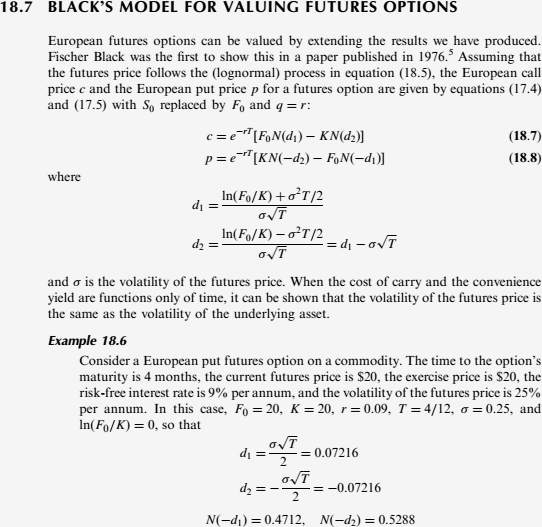

What is the delta of a short position in 1000 European call options on silver futures? The options mature in eight months, and the futures contract underlying the option matures in nine months. The current nine-month futures price is $8 per ounce, the exercise price of the options is $8, the risk-free interest rate is 12% per annum, and the volatility of silver is 18% per annum.

Choose one answer.

a. 122.2

b. 585.5

c. 488.6

d. 765.4

I am clueless how to go about, may be d1 & d2...

Thanks

Rahul

Please help on the below

What is the delta of a short position in 1000 European call options on silver futures? The options mature in eight months, and the futures contract underlying the option matures in nine months. The current nine-month futures price is $8 per ounce, the exercise price of the options is $8, the risk-free interest rate is 12% per annum, and the volatility of silver is 18% per annum.

Choose one answer.

a. 122.2

b. 585.5

c. 488.6

d. 765.4

I am clueless how to go about, may be d1 & d2...

Thanks

Rahul