Hi David,

Regarding AIM: Describe a waterfall structure in securitization (Malz, Chapter 9 Structured Credit risk)

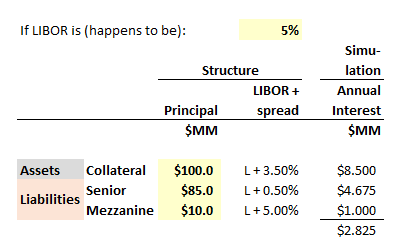

On page 34 of our notes could you kindly explain how the principal of 85 for senior tranche and principal of 10 for the mezzanine tranche in the example were calculated please?

Many thanks.

Regarding AIM: Describe a waterfall structure in securitization (Malz, Chapter 9 Structured Credit risk)

On page 34 of our notes could you kindly explain how the principal of 85 for senior tranche and principal of 10 for the mezzanine tranche in the example were calculated please?

Many thanks.

Last edited: