You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

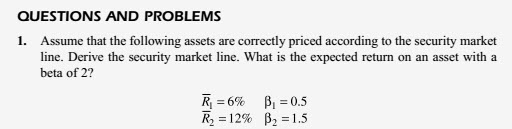

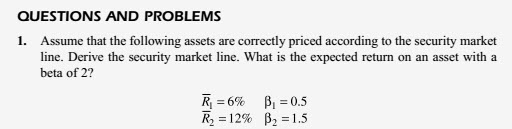

Elton Question 13.1,Video,Apply the CAPM in calculating the expected return on an asset-

- Thread starter Branislav

- Start date

-

- Tags

- capm elton expected-return

Hi @Branislav That's is Elton's Question 13.1 and, you are correct, they do not provide the riskfree rate. It is not necessary: we have two equations and we can solve for two variables, in this case, we can solve for both the market risk premium (MRP) and the risk-free rate. I'm not sure why I included the risk-free rate, but you do appear to be correct, I don't think you are missing anything!

JamesVU2000

Member

A stock has a beta of 0.75 and an expected return of 13%. The risk-free rate is 4%. Calculate the market

risk premium and the expected return on the market portfolio.

Answer:

According to CAPM: 0.13 = 0.04 + 0.75[E(RM) − RF].

Therefore, the market risk premium is equal to: [E(RM) − RF] = 0.12 = 12%.

The expected return on the market is calculated as: [E(RM) − 0.04] = 0.12, or E(RM) = 0.16 = 16%.

If anyone could help me with the algebra I would appreciate it. not urgent for David or Nicole to answer

risk premium and the expected return on the market portfolio.

Answer:

According to CAPM: 0.13 = 0.04 + 0.75[E(RM) − RF].

Therefore, the market risk premium is equal to: [E(RM) − RF] = 0.12 = 12%.

The expected return on the market is calculated as: [E(RM) − 0.04] = 0.12, or E(RM) = 0.16 = 16%.

If anyone could help me with the algebra I would appreciate it. not urgent for David or Nicole to answer

A stock has a beta of 0.75 and an expected return of 13%. The risk-free rate is 4%. Calculate the market

risk premium and the expected return on the market portfolio.

Answer:

According to CAPM: 0.13 = 0.04 + 0.75[E(RM) − RF].

Therefore, the market risk premium is equal to: [E(RM) − RF] = 0.12 = 12%.

The expected return on the market is calculated as: [E(RM) − 0.04] = 0.12, or E(RM) = 0.16 = 16%.

If anyone could help me with the algebra I would appreciate it. not urgent for David or Nicole to answer

If you agree with CAPM...

ER_i = RF + BETA_i(E(RM) - RF))

Plugging in givens:

13% = 4% + 0.75(E(RM) - 4%)

(13% - 4%) = 0.75(E(RM) - 4%)

9% = 0.75(E(RM) - 4%)

9%/0.75 = E(RM) - 4%

12% = E(RM) - 4% --> Note: this is E(RM) - RF = Market Risk Premium

16% = E(RM)

The expected return on market portfolio is 16%, and risk premium is E(RM) - RF = 16% - 4% = 12%.

JamesVU2000

Member

thank you for the help