P1 only.

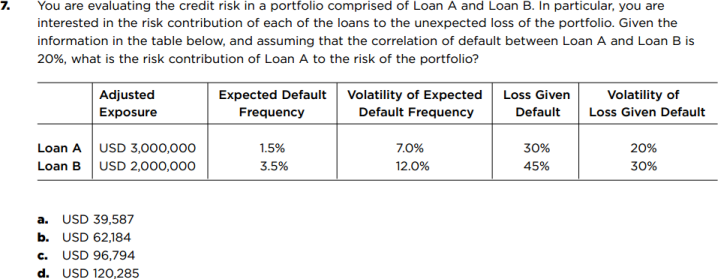

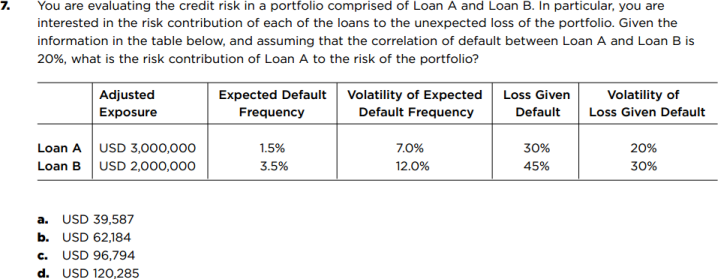

GARP's 2012 Practice Exam Part 2, Question 7 features a table (see below) which contains assumptions for two loan exposures. A Part 1 candidate should be able to find the error:

Question: What is wrong with the exhibit above?

GARP's 2012 Practice Exam Part 2, Question 7 features a table (see below) which contains assumptions for two loan exposures. A Part 1 candidate should be able to find the error:

Question: What is wrong with the exhibit above?