Fran

Administrator

AIMs: Interpret and calculate the variance for a portfolio and understand the derivation of the minimum variance hedge ratio.

Questions:

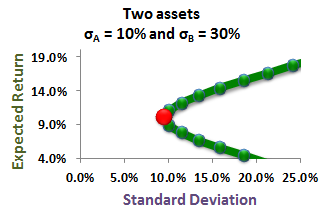

305.1. A two-asset portfolio contains a long position in commodity (T) with volatility of 10.0% and a long position in stock (S) with volatility of 30.0%. The assets are uncorrelated: rho(T,S) = zero (0). What weight (0 to 100%) of the portfolio should be allocated to the commodity if the goal is a minimum variance portfolio (in percentage terms, as no dollars are introduced)?

a. 62.5%

b. 75.0%

c. 83.3%

d. 90.0%

305.2. A portfolio manager owns (has a long position in) $100 of Security A which has a volatility of 9.0%. She wants to hedge with Security B which has a volatility of 15.0%. The correlation between the securities is 0.40; rho(A,B) = +0.40. What position in Security B utilizes the minimum variance hedge ratio to create a portfolio with the minimum dollar ($) standard deviation?

a. Long $60.0

b. Short $24.0

c. Short $60.0

d. Short $76.0

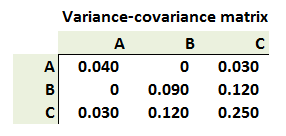

305.3. A portfolio of $3.00 is equally invested in three securities (A, B and C), such that $1.00 is conveniently invested in each security, where the relationship between the securities is characterized by the following variance-covariance matrix:

For example, the volatility of security A's returns is SQRT(0.040) = 20% and the covariance (B,C) = 0.120. What is the portfolio's dollar standard deviation?

a. $0.41

b. $0.55

c. $0.82

d. $1.34

Answers:

Questions:

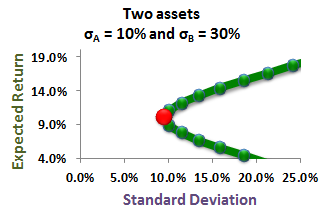

305.1. A two-asset portfolio contains a long position in commodity (T) with volatility of 10.0% and a long position in stock (S) with volatility of 30.0%. The assets are uncorrelated: rho(T,S) = zero (0). What weight (0 to 100%) of the portfolio should be allocated to the commodity if the goal is a minimum variance portfolio (in percentage terms, as no dollars are introduced)?

a. 62.5%

b. 75.0%

c. 83.3%

d. 90.0%

305.2. A portfolio manager owns (has a long position in) $100 of Security A which has a volatility of 9.0%. She wants to hedge with Security B which has a volatility of 15.0%. The correlation between the securities is 0.40; rho(A,B) = +0.40. What position in Security B utilizes the minimum variance hedge ratio to create a portfolio with the minimum dollar ($) standard deviation?

a. Long $60.0

b. Short $24.0

c. Short $60.0

d. Short $76.0

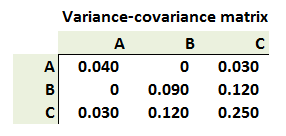

305.3. A portfolio of $3.00 is equally invested in three securities (A, B and C), such that $1.00 is conveniently invested in each security, where the relationship between the securities is characterized by the following variance-covariance matrix:

For example, the volatility of security A's returns is SQRT(0.040) = 20% and the covariance (B,C) = 0.120. What is the portfolio's dollar standard deviation?

a. $0.41

b. $0.55

c. $0.82

d. $1.34

Answers: