Learning objectives: Calculate the theoretical price of a bond using spot rates. Derive forward interest rates from a set of spot rates. Derive the value of the cash flows from a forward rate agreement (FRA).

Questions:

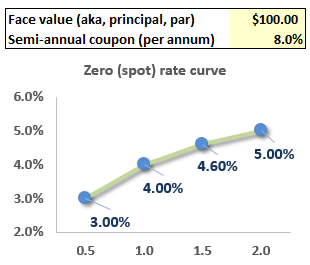

713.1. Consider the steep spot (aka, zero) rate curve illustrated below: 3.0% at 0.5 years, 4.0% at 1.0 year, 4.6% at 1.5 years and 5.0% at 2.0 years. Each of these zero rates is per annum with continuous compounding.

Which of the following is nearest to the theoretical price of a two-year $100.00 face value bond that pays an 8.0% semi-annual coupon (4.0% coupon every six months)?

a. $97.31

b. $99.47

c. $102.38

d. $105.62

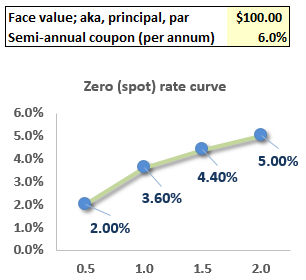

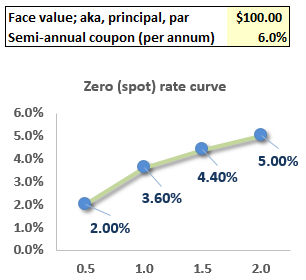

713.2. Consider the steep spot (aka, zero) rate curve illustrated below: 2.0% at 0.5 years, 3.60% at 1.0 year, 4.40% at 1.5 years and 5.0% at 2.0 years. Each of these zero rates is per annum with annual compounding.

We are interested in the yield-to-maturity (aka, yield) of a two-year $100.00 face value bond that pays an 6.0% semi-annual coupon (3.0% coupon every six months). If this yield-to-maturity is expressed with semi-annual compounding (aka, bond equivalent basis), which of the following is nearest to this yield?

a. 2.52%

b. 3.95%

c. 4.88%

d. 5.00%

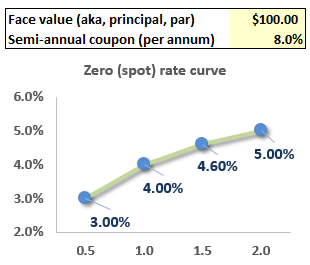

713.3. Consider the following steeply upward-sloping spot rate (aka, zero rate) curve where the per annum zero rates are given with continuous compounding (CC):

Which of the following is nearest to the implied six-month forward rate beginning in 1.5 years, F(1.5, 2.0), but where the six-month forward rate is expressed per annum with semi-annual compounding?

a. 3.78%

b. 4.80%

c. 5.90%

d. 6.50%

Answers here:

Questions:

713.1. Consider the steep spot (aka, zero) rate curve illustrated below: 3.0% at 0.5 years, 4.0% at 1.0 year, 4.6% at 1.5 years and 5.0% at 2.0 years. Each of these zero rates is per annum with continuous compounding.

Which of the following is nearest to the theoretical price of a two-year $100.00 face value bond that pays an 8.0% semi-annual coupon (4.0% coupon every six months)?

a. $97.31

b. $99.47

c. $102.38

d. $105.62

713.2. Consider the steep spot (aka, zero) rate curve illustrated below: 2.0% at 0.5 years, 3.60% at 1.0 year, 4.40% at 1.5 years and 5.0% at 2.0 years. Each of these zero rates is per annum with annual compounding.

We are interested in the yield-to-maturity (aka, yield) of a two-year $100.00 face value bond that pays an 6.0% semi-annual coupon (3.0% coupon every six months). If this yield-to-maturity is expressed with semi-annual compounding (aka, bond equivalent basis), which of the following is nearest to this yield?

a. 2.52%

b. 3.95%

c. 4.88%

d. 5.00%

713.3. Consider the following steeply upward-sloping spot rate (aka, zero rate) curve where the per annum zero rates are given with continuous compounding (CC):

Which of the following is nearest to the implied six-month forward rate beginning in 1.5 years, F(1.5, 2.0), but where the six-month forward rate is expressed per annum with semi-annual compounding?

a. 3.78%

b. 4.80%

c. 5.90%

d. 6.50%

Answers here: