AIM: Explain the impact of netting on exposure, the benefit of correlation, and calculate the netting factor. Explain the impact of collateralization on exposure, and assess the risk associated with the remargining period.

Questions:

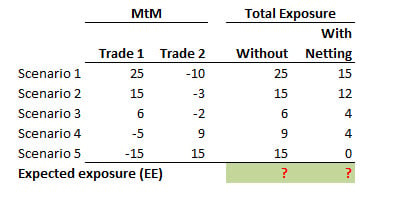

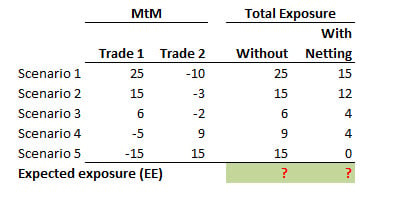

414.1. The following table illustrates the impact of netting when there is negative correlation between future values:

The expected exposure should assume that each scenario has equal weight. Which is nearest to the netting factor?

a. zero

b. 25%

c. 50%

d. 100%

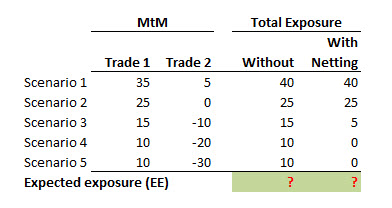

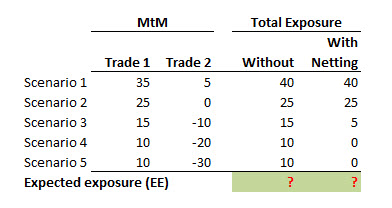

414.2. The following table illustrates the impact of netting when there is a positive future value (while the correlation is highly positive):

The expected exposure should assume that each scenario has equal weight. Which is nearest to the netting factor?

a. 35%

b. 50%

c. 65%

d. 80%

414.3. Similar to Gregory's example, assume a two-way CSA with the following identical parameters for both counterparties:

1. The portfolio mark to market (MtM) increases to $1,430,000 (1.430 million) on the first day, T(1)

2. The portfolio mark to market (MtM) decreases to $1,030,000 (1.030 million) on the second day, T(2)

Which of the following is the correct sequence of collateral calls (returns) from the perspective of Party A?

a. On first day post collateral of $450,000, then return collateral of $400,000 on the second day

b. On first day return collateral of $225,000, then post collateral of $100,000 on the second day

c. On first day post collateral of $175,000, then post collateral of $200,000 on the second day

d. Neither post nor return collateral on either the first or second day

(Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Answers here:

Questions:

414.1. The following table illustrates the impact of netting when there is negative correlation between future values:

The expected exposure should assume that each scenario has equal weight. Which is nearest to the netting factor?

a. zero

b. 25%

c. 50%

d. 100%

414.2. The following table illustrates the impact of netting when there is a positive future value (while the correlation is highly positive):

The expected exposure should assume that each scenario has equal weight. Which is nearest to the netting factor?

a. 35%

b. 50%

c. 65%

d. 80%

414.3. Similar to Gregory's example, assume a two-way CSA with the following identical parameters for both counterparties:

- Threshold is equal to $1,000,000

- Independent amount is equal to $200,000

- Minimum transfer amount (MTA) is equal to $100,000

- Rounding (up) equal to $25,000, and

- Initial collateral held, T(0), equal to zero

1. The portfolio mark to market (MtM) increases to $1,430,000 (1.430 million) on the first day, T(1)

2. The portfolio mark to market (MtM) decreases to $1,030,000 (1.030 million) on the second day, T(2)

Which of the following is the correct sequence of collateral calls (returns) from the perspective of Party A?

a. On first day post collateral of $450,000, then return collateral of $400,000 on the second day

b. On first day return collateral of $225,000, then post collateral of $100,000 on the second day

c. On first day post collateral of $175,000, then post collateral of $200,000 on the second day

d. Neither post nor return collateral on either the first or second day

(Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Answers here: