frmengineer

New Member

Hi David,

Can you please show (expand) the ULp formula for 4 assets ? I want to know how the formula works (or how it looks like in 4 assets) instead of just memorizing the formula you provide us for 2 assets ? What if we were asked to find ULp for 5 assets...how would the formula looks like ?

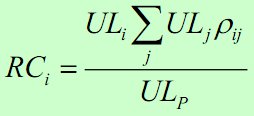

2) Can you please also expand/show the Risk Contribution (RC) formula to 4 assets ?

Thanks a lot !

Can you please show (expand) the ULp formula for 4 assets ? I want to know how the formula works (or how it looks like in 4 assets) instead of just memorizing the formula you provide us for 2 assets ? What if we were asked to find ULp for 5 assets...how would the formula looks like ?

2) Can you please also expand/show the Risk Contribution (RC) formula to 4 assets ?

Thanks a lot !