Questions:

603.1. An asset (e.g., stock) with a current price of $40.00 has a daily 99.0% value at risk (VaR) of $2.00. If asset returns are i.i.d. normal with an expected daily return of zero and we assume 250 trading days per year, which is nearest to the stock's annualized volatility?

a. 22.0%

b. 34.0%

c. 47.0%

d. 55.0%

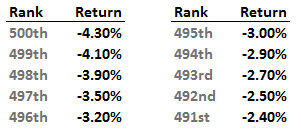

603.2. You are computing downside performance measures for a portfolio based on its performance over the last two years. You rank five hundred (T = 500) daily returns and the ten worst are listed below; i.e., the worst daily return over the two years was -4.30%, the 2nd worst was -4.10%:

What is the difference between the 99.0% historical value at risk (VaR) and the 99.0% expected shortfall (ES)?

a. No difference

b. 35 basis points

c. 80 basis points

d. 140 basis points

603.3. In January 2016, Basel (BCBS) published new capital requirements for market risk. The requirements included revised internal models approach (IMA) which replaces two value at risk metrics (ie, VaR and stressed VaR) with a single expected shortfall (ES). In terms of horizon and confidence level, the shift is from a 10-day 99.0% VaR to a 10-day 97.5%. According to Basel, "a shift from Value-at-Risk (VaR) to an Expected Shortfall (ES) measure of risk under stress. Use of ES will help to ensure a more prudent capture of 'tail risk' and capital adequacy during periods of significant financial market stress." (Source: Basel Committee on Banking Supervision, “Minimum capital requirements for market risk”, January 2016.)

Specifically, the new requirements specify the following minimum standards: "181. Banks will have flexibility in devising the precise nature of their models, but the following minimum standards will apply for the purpose of calculating their capital charge. Individual banks or their supervisory authorities will have discretion to apply stricter standards.

(a) 'Expected shortfall' must be computed on a daily basis for the bank-wide internal model for regulatory capital purposes. Expected shortfall must also be computed on a daily basis for each trading desk that a bank wishes to include within the scope for the internal model for regulatory capital purposes.

(b) In calculating the expected shortfall, a 97.5th percentile, one-tailed confidence level is to be used." (Source: Basel Committee on Banking Supervision, “Minimum capital requirements for market risk”, January 2016.)

In regard to value at risk (VaR) and expected shortfall (ES), each of the following is true EXCEPT which is not necessarily true?

a. It is more difficult to backtest ES than to backtest VaR which is a disadvantage of ES

b. Both VaR and ES are necessarily increasing with longer horizon and/or higher confidence level

c. Given the same distribution, on a L(+)/P(-) scale where losses are positives, a 97.5% ES must be less than (ie, imply less capital required) than a 99.0% VaR

d. In theory (ie, without regard to the new BCBS requirements), the calculation of either VaR or ES can be validly approached in any of the three methods: variance/covariance (aka, delta normal), historical simulation, or Monte Carlo

Answers:

603.1. An asset (e.g., stock) with a current price of $40.00 has a daily 99.0% value at risk (VaR) of $2.00. If asset returns are i.i.d. normal with an expected daily return of zero and we assume 250 trading days per year, which is nearest to the stock's annualized volatility?

a. 22.0%

b. 34.0%

c. 47.0%

d. 55.0%

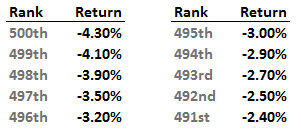

603.2. You are computing downside performance measures for a portfolio based on its performance over the last two years. You rank five hundred (T = 500) daily returns and the ten worst are listed below; i.e., the worst daily return over the two years was -4.30%, the 2nd worst was -4.10%:

What is the difference between the 99.0% historical value at risk (VaR) and the 99.0% expected shortfall (ES)?

a. No difference

b. 35 basis points

c. 80 basis points

d. 140 basis points

603.3. In January 2016, Basel (BCBS) published new capital requirements for market risk. The requirements included revised internal models approach (IMA) which replaces two value at risk metrics (ie, VaR and stressed VaR) with a single expected shortfall (ES). In terms of horizon and confidence level, the shift is from a 10-day 99.0% VaR to a 10-day 97.5%. According to Basel, "a shift from Value-at-Risk (VaR) to an Expected Shortfall (ES) measure of risk under stress. Use of ES will help to ensure a more prudent capture of 'tail risk' and capital adequacy during periods of significant financial market stress." (Source: Basel Committee on Banking Supervision, “Minimum capital requirements for market risk”, January 2016.)

Specifically, the new requirements specify the following minimum standards: "181. Banks will have flexibility in devising the precise nature of their models, but the following minimum standards will apply for the purpose of calculating their capital charge. Individual banks or their supervisory authorities will have discretion to apply stricter standards.

(a) 'Expected shortfall' must be computed on a daily basis for the bank-wide internal model for regulatory capital purposes. Expected shortfall must also be computed on a daily basis for each trading desk that a bank wishes to include within the scope for the internal model for regulatory capital purposes.

(b) In calculating the expected shortfall, a 97.5th percentile, one-tailed confidence level is to be used." (Source: Basel Committee on Banking Supervision, “Minimum capital requirements for market risk”, January 2016.)

In regard to value at risk (VaR) and expected shortfall (ES), each of the following is true EXCEPT which is not necessarily true?

a. It is more difficult to backtest ES than to backtest VaR which is a disadvantage of ES

b. Both VaR and ES are necessarily increasing with longer horizon and/or higher confidence level

c. Given the same distribution, on a L(+)/P(-) scale where losses are positives, a 97.5% ES must be less than (ie, imply less capital required) than a 99.0% VaR

d. In theory (ie, without regard to the new BCBS requirements), the calculation of either VaR or ES can be validly approached in any of the three methods: variance/covariance (aka, delta normal), historical simulation, or Monte Carlo

Answers:

Last edited by a moderator: