Learning objectives: Explain mean reversion and how it is captured in the GARCH(1,1) model. Explain the weights in the EWMA and GARCH(1,1) models. Explain how GARCH models perform in volatility forecasting. Describe the volatility term structure and the impact of volatility changes.

Questions:

704.1. The most recent estimate of the daily volatility of an asset, σ(n-1), is 3.0% and the price of the asset at the close of trading yesterday was $42.00. The price of the asset at the close of trading today is $45.78. In order to update the volatility, you are trying to choose between two different volatility models:

a. EWMA assigns 8.14% to return^2 that is ten days old, u(n-10)^2, which is more than GARCH

b. GARCH assigns 2.55% to return^2 that is ten days old, u(n-10)^2, which is more than EWMA

c. They both assign the SAME weight of 1.13% to return^2 that is ten days old, u(n-10)^2

d. We do not have enough information because the long run variance in GARCH(1,1) is not given

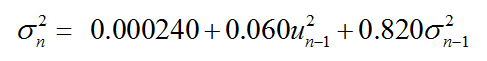

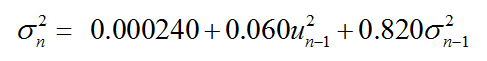

704.2. Consider the following GARCH(1,1) model where ω = 0.000240, α = 0.060, and β = 0.820:

Each of the following is true about this GARCH model EXCEPT which statement is false?

a. The model's implied long-run volatility equals sqrt(0.0020) or about 4.4721%

b. If we increase beta, β, from 0.820 to 0.850, ceteris paribus the implied long-run volatility increases

c. If we increase alpha, α, from 0.060 to 0.090, ceteris paribus the implied long-run volatility decreases

d. If we double omega, ω, from 0.000240 to 0.000480, ceteris paribus the implied long-run volatility increases by about 41.4%

704.3. The parameters of a GARCH( 1,1) model for daily variance are estimated as ω = 0.0000900 (ie, 9.0E-05), α = 0.030, and β = 0.880. If the current annualized volatility is 25.0% per annum with 250 trading days per year, which is nearest to the expected daily volatility in 10 days? (note: variation on Hull's end of chapter question #14).

a. 1.58%

b. 1.99%

c. 2.66%

d. 3.16%

Answers here:

Questions:

704.1. The most recent estimate of the daily volatility of an asset, σ(n-1), is 3.0% and the price of the asset at the close of trading yesterday was $42.00. The price of the asset at the close of trading today is $45.78. In order to update the volatility, you are trying to choose between two different volatility models:

- EWMA with lambda parameter, λ = 0.780

- GARCH(1,1) with parameters α = 0.110, β = 0.850, and ω = 0.00040

a. EWMA assigns 8.14% to return^2 that is ten days old, u(n-10)^2, which is more than GARCH

b. GARCH assigns 2.55% to return^2 that is ten days old, u(n-10)^2, which is more than EWMA

c. They both assign the SAME weight of 1.13% to return^2 that is ten days old, u(n-10)^2

d. We do not have enough information because the long run variance in GARCH(1,1) is not given

704.2. Consider the following GARCH(1,1) model where ω = 0.000240, α = 0.060, and β = 0.820:

Each of the following is true about this GARCH model EXCEPT which statement is false?

a. The model's implied long-run volatility equals sqrt(0.0020) or about 4.4721%

b. If we increase beta, β, from 0.820 to 0.850, ceteris paribus the implied long-run volatility increases

c. If we increase alpha, α, from 0.060 to 0.090, ceteris paribus the implied long-run volatility decreases

d. If we double omega, ω, from 0.000240 to 0.000480, ceteris paribus the implied long-run volatility increases by about 41.4%

704.3. The parameters of a GARCH( 1,1) model for daily variance are estimated as ω = 0.0000900 (ie, 9.0E-05), α = 0.030, and β = 0.880. If the current annualized volatility is 25.0% per annum with 250 trading days per year, which is nearest to the expected daily volatility in 10 days? (note: variation on Hull's end of chapter question #14).

a. 1.58%

b. 1.99%

c. 2.66%

d. 3.16%

Answers here:

Last edited by a moderator: