Learning objectives: Calculate and interpret the sample mean and sample variance. Construct and interpret a confidence interval. Construct an appropriate null and alternative hypothesis, and calculate an appropriate test statistic.

Questions:

For the following questions, please feel free to rely on the statistical lookup tables provided here: http://trtl.bz/T2-715-lookup-tables. This document contains four lookup tables (note that each also contains an example): cumulative standard normal distribution, student's t distribution, chi-squared distribution, and F distribution.

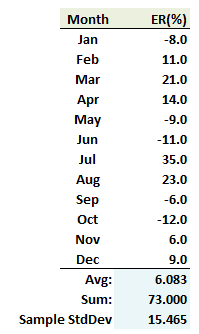

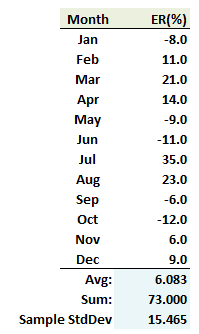

718.1. An alternative investments portfolio manager with a very risk trading strategy turns in her first year's (n = 12 months) performance, as displayed below. Her fund's average monthly excess return was +6.083% with volatility (i.e., sample standard deviation) of 15.465%.

If we concede that her true volatility is unknown but we do assume her true returns are normal (note: true is a synonym for population), then what is the probability that her true excess return is greater than zero? (Note: inspired by Miller's EOC question 7.1 - Michael Miller, Mathematics and Statistics for Financial Risk Management, 2nd Edition (Hoboken, NJ: John Wiley & Sons, 2013).

a. 17.3%

b. 80.0%

c. 90.0%

d. 91.3%

718.2. You are told that the monthly log returns of a bitcoin index are normally distributed with a standard deviation of 29.0%. You have only 36 months of data, as the index is relatively new, from which you calculate the sample variance. Which is nearest to the standard deviation of this estimate of the sample variance? (Note: variation on Miller's EOC question 7.6 - Michael Miller, Mathematics and Statistics for Financial Risk Management, 2nd Edition (Hoboken, NJ: John Wiley & Sons, 2013).

a. 2.0%

b. 5.0%

c. 10.0%

d. 18.0%

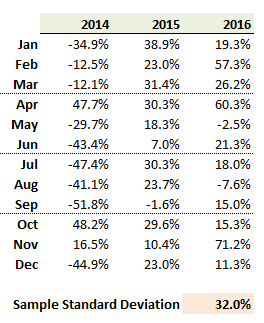

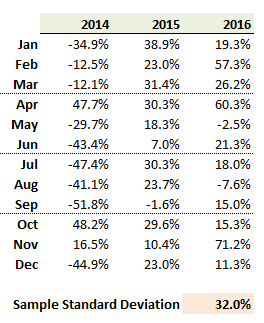

718.3. The promoter of a new cryptocurrency claims that its monthly price volatility is 25.0%, or more specifically, is not greater than 25.0%. The monthly returns for the most recent 36 months are displayed below; the sample volatility is observed to be 32.0%.

Which is nearest to the probability that the promoter's claim is correct and the true price volatility of the cryptocurrency is less than or equal to 25.0%?

a. About 1.0%

b. About 5.0%

c. About 11.3%

d. About 20.0%

Answers here:

Questions:

For the following questions, please feel free to rely on the statistical lookup tables provided here: http://trtl.bz/T2-715-lookup-tables. This document contains four lookup tables (note that each also contains an example): cumulative standard normal distribution, student's t distribution, chi-squared distribution, and F distribution.

718.1. An alternative investments portfolio manager with a very risk trading strategy turns in her first year's (n = 12 months) performance, as displayed below. Her fund's average monthly excess return was +6.083% with volatility (i.e., sample standard deviation) of 15.465%.

If we concede that her true volatility is unknown but we do assume her true returns are normal (note: true is a synonym for population), then what is the probability that her true excess return is greater than zero? (Note: inspired by Miller's EOC question 7.1 - Michael Miller, Mathematics and Statistics for Financial Risk Management, 2nd Edition (Hoboken, NJ: John Wiley & Sons, 2013).

a. 17.3%

b. 80.0%

c. 90.0%

d. 91.3%

718.2. You are told that the monthly log returns of a bitcoin index are normally distributed with a standard deviation of 29.0%. You have only 36 months of data, as the index is relatively new, from which you calculate the sample variance. Which is nearest to the standard deviation of this estimate of the sample variance? (Note: variation on Miller's EOC question 7.6 - Michael Miller, Mathematics and Statistics for Financial Risk Management, 2nd Edition (Hoboken, NJ: John Wiley & Sons, 2013).

a. 2.0%

b. 5.0%

c. 10.0%

d. 18.0%

718.3. The promoter of a new cryptocurrency claims that its monthly price volatility is 25.0%, or more specifically, is not greater than 25.0%. The monthly returns for the most recent 36 months are displayed below; the sample volatility is observed to be 32.0%.

Which is nearest to the probability that the promoter's claim is correct and the true price volatility of the cryptocurrency is less than or equal to 25.0%?

a. About 1.0%

b. About 5.0%

c. About 11.3%

d. About 20.0%

Answers here:

Last edited: