AIMs: Describe and calculate the following metrics for credit exposure: ... expected positive exposure and negative exposure, effective exposure, and maximum exposure. Compare the characterization of credit exposure to VaR methods and describe additional considerations used in the determination of credit exposure.

Questions:

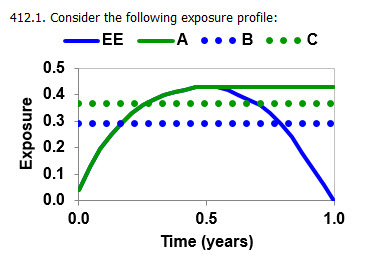

412.1. Consider the following exposure profile:

If we assume the blue line is the expected exposure (EE) then each of the following is therefore plausible, EXCEPT which is not true?

a. Line A (solid green) is the effective expected exposure (effective EE) which is the non-decreasing EE

b. Line A (solid green), only because the EE is unimodal (with one peak), is also the maximum potential future exposure (maximum PFE)

c. Line B (dotted blue) is the expected positive exposure (EPE), often called the "loan equivalent," and is a single number because it is the average of the expected exposures over the time horizon

d. Line C (dotted green) is the effective expected positive exposure (EEPE), and is a single number because it is the average of the effective EE

412.2. In order to determine the counterparty credit risk capital charge, the Basel III regulatory framework requires the calculation of an effective expected positive exposure (effective EPE or EEPE) with stressed parameters. In regard to Basel III's stressed EPE, specifically, "Expected positive exposure (EPE) must be calculated with parameter calibration based on stressed data. This has arisen due to the procyclical issues of using historical data where non-volatile markets lead to smaller risk numbers, which in turn reduce capital requirements. This use of stressed data is also intended to capture general wrong-way risk more accurately." (Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Each of the following is true about the EEPE, EXCEPT which is false?

a. If expected exposure (EE) increases over a few months, to a peak, then declines back toward zero toward then end of the year, then EEPE must be greater than EPE

b. If expected exposure (EE) is monotonically increasing, then EEPE will be identical to EPE

c. The intent of the non-decreasing constraint (in effective EE and EEPE) is to capture the roll-off impact or "rollover risk" (that would otherwise be missed) for transactions that are close to maturity but in practice are likely to be replaced

d. Because EEPE is a weighted average over time, it is a single number but it depends on the confidence level which is typically set to 99.0% but "can be calibrated at more conservative (i.e., higher) levels" under Basel III

412.3. Gregory compares credit exposure, as a fundamental credit risk measure, to value at risk (VaR), which is, of course, a fundamental market risk measure. In comparing and contrasting credit exposure to VaR, each of the following is true, according to Gregory, EXCEPT which is false?

a. Unlike VAR, credit exposure needs to be defined over multiple time horizons (often far in the future) so as to understand fully the impact of time and specifics of the underlying contracts

b. Unlike VaR, credit exposure often must model complex and/or subjective (including legal interpretations) factors due to the presence of risk mitigants such as netting and collateral

c. Unlike VaR which depends critically on the portfolio's expected future value (EFV), credit exposure is measured according to a future simulation which does not depend on expected future value

d. VaR is a risk measure not a valuation measure, but credit exposure is defined for both risk and valuation (pricing) and this in general implies "two completely different sets of calculations;" i.e., risk versus pricing

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Answers here:

Questions:

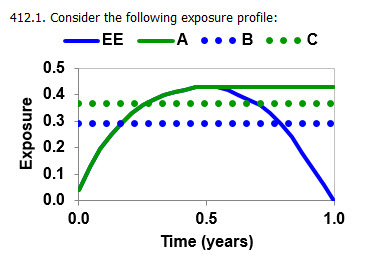

412.1. Consider the following exposure profile:

If we assume the blue line is the expected exposure (EE) then each of the following is therefore plausible, EXCEPT which is not true?

a. Line A (solid green) is the effective expected exposure (effective EE) which is the non-decreasing EE

b. Line A (solid green), only because the EE is unimodal (with one peak), is also the maximum potential future exposure (maximum PFE)

c. Line B (dotted blue) is the expected positive exposure (EPE), often called the "loan equivalent," and is a single number because it is the average of the expected exposures over the time horizon

d. Line C (dotted green) is the effective expected positive exposure (EEPE), and is a single number because it is the average of the effective EE

412.2. In order to determine the counterparty credit risk capital charge, the Basel III regulatory framework requires the calculation of an effective expected positive exposure (effective EPE or EEPE) with stressed parameters. In regard to Basel III's stressed EPE, specifically, "Expected positive exposure (EPE) must be calculated with parameter calibration based on stressed data. This has arisen due to the procyclical issues of using historical data where non-volatile markets lead to smaller risk numbers, which in turn reduce capital requirements. This use of stressed data is also intended to capture general wrong-way risk more accurately." (Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Each of the following is true about the EEPE, EXCEPT which is false?

a. If expected exposure (EE) increases over a few months, to a peak, then declines back toward zero toward then end of the year, then EEPE must be greater than EPE

b. If expected exposure (EE) is monotonically increasing, then EEPE will be identical to EPE

c. The intent of the non-decreasing constraint (in effective EE and EEPE) is to capture the roll-off impact or "rollover risk" (that would otherwise be missed) for transactions that are close to maturity but in practice are likely to be replaced

d. Because EEPE is a weighted average over time, it is a single number but it depends on the confidence level which is typically set to 99.0% but "can be calibrated at more conservative (i.e., higher) levels" under Basel III

412.3. Gregory compares credit exposure, as a fundamental credit risk measure, to value at risk (VaR), which is, of course, a fundamental market risk measure. In comparing and contrasting credit exposure to VaR, each of the following is true, according to Gregory, EXCEPT which is false?

a. Unlike VAR, credit exposure needs to be defined over multiple time horizons (often far in the future) so as to understand fully the impact of time and specifics of the underlying contracts

b. Unlike VaR, credit exposure often must model complex and/or subjective (including legal interpretations) factors due to the presence of risk mitigants such as netting and collateral

c. Unlike VaR which depends critically on the portfolio's expected future value (EFV), credit exposure is measured according to a future simulation which does not depend on expected future value

d. VaR is a risk measure not a valuation measure, but credit exposure is defined for both risk and valuation (pricing) and this in general implies "two completely different sets of calculations;" i.e., risk versus pricing

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

Answers here: