Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

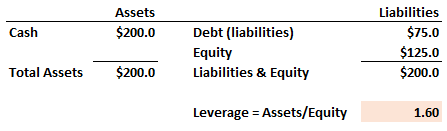

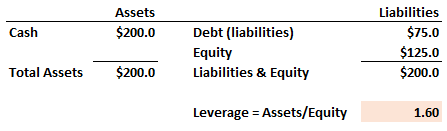

707.1. Suppose that a hedge fund account, Lever Brothers Multistrategy Masters Fund LP, opens with an initial placement of $125.0 million in equity by its owners and $75.0 million in debt. As such, the firm's initial leverage is 1.60 as illustrated by this economic balance sheet:

Consider the following three transactions in sequence:

a. 1.00

b. 1.60

c. 2.40

d. 3.50

707.2. A key distinction is between market liquidity risk (aka, transaction liquidity risk) and funding liquidity risk (aka, balance sheet risk). As Malz (chapter 12) explains, "The term “liquidity” has been defined in myriad ways that ultimately boil down to two properties, transactions liquidity, a property of assets or markets, and funding liquidity, which is more closely related to creditworthiness. Transaction liquidity is the property of an asset being easy to exchange for other assets. Most financial institutions are heavily leveraged; that is, they borrow heavily to finance their assets, compared to the typical nonfinancial firm. Funding liquidity is the ability to finance assets continuously at an acceptable borrowing rate. For financial firms, many of those assets include short positions and derivatives."

Digging a bit deeper, each of the following statements about liquidity risk is true EXCEPT which is false?

a A firm that is "solvent" cannot experience funding (balance sheet) illiquidity, but a firm that is "insolvent" by definition does necessarily experience funding illiquidity

b. The bid-ask spread is measure of "tightness" (aka, width) and therefore a characteristic of market liquidity risk; and it can easily be included in liquidity-adjusted value at risk (LVaR) as an exogenous factor

c. "Depth" describes how large an order it takes to move the market adversely; and if there is a lack of depth, then LVaR can include this endogenous factor by incorporating the elasticity of demand, or by scaling VaR according to the "time to escape;" i.e., the estimated number of days required for orderly liquidation of the position

d. Traditional functions of a commercial bank include "maturity transformation" and "liquidity transformation," but these functions tend to create balance sheet risk which, in turn, requires asset-liability management (ALM) techniques

707.3. Peter is a Risk Manager who is analyzing an equity position of 20,000 shares in an semi-liquid, non-public stock that has a current price of USD $50.00 per share. While Peter assumes the stock's daily expected return is zero, its estimated daily return volatility is 100 basis points (1.00%). The mean bid-ask spread is USD $0.40 (80 basis points). The bid-ask spread volatility is 20 basis points, and Peter will assume the volatility spread multiplier, k = 3.0. Finally, Peter will assume normally distributed arithmetic returns (he will not assume normally distributed geometric returns; aka, lognormal).

Which of the following is nearest to the one-day 95.0% confident normal liquidity-adjusted value at risk (LVaR) using the exogenous spread (aka, volatile spread) approach?

a. $16,450

b. $23,450

c. $29,170

d. $33,330

Answers here:

Questions:

707.1. Suppose that a hedge fund account, Lever Brothers Multistrategy Masters Fund LP, opens with an initial placement of $125.0 million in equity by its owners and $75.0 million in debt. As such, the firm's initial leverage is 1.60 as illustrated by this economic balance sheet:

Consider the following three transactions in sequence:

- The purchase of stock with a value of $40.0 million (ie., a long equity position) where 50.0% of the purchase is borrowed from the broker (aka, margin loan) and the fund's cash is used for the remaining $20.0 million

- A three-month currency forward in which the firm is short $30.0 million against the euro

- An at-the-money two-month long call option on S&P 500 equity index futures with an underlying index value of $100; where the option is assumed to be 50-delta.

a. 1.00

b. 1.60

c. 2.40

d. 3.50

707.2. A key distinction is between market liquidity risk (aka, transaction liquidity risk) and funding liquidity risk (aka, balance sheet risk). As Malz (chapter 12) explains, "The term “liquidity” has been defined in myriad ways that ultimately boil down to two properties, transactions liquidity, a property of assets or markets, and funding liquidity, which is more closely related to creditworthiness. Transaction liquidity is the property of an asset being easy to exchange for other assets. Most financial institutions are heavily leveraged; that is, they borrow heavily to finance their assets, compared to the typical nonfinancial firm. Funding liquidity is the ability to finance assets continuously at an acceptable borrowing rate. For financial firms, many of those assets include short positions and derivatives."

Digging a bit deeper, each of the following statements about liquidity risk is true EXCEPT which is false?

a A firm that is "solvent" cannot experience funding (balance sheet) illiquidity, but a firm that is "insolvent" by definition does necessarily experience funding illiquidity

b. The bid-ask spread is measure of "tightness" (aka, width) and therefore a characteristic of market liquidity risk; and it can easily be included in liquidity-adjusted value at risk (LVaR) as an exogenous factor

c. "Depth" describes how large an order it takes to move the market adversely; and if there is a lack of depth, then LVaR can include this endogenous factor by incorporating the elasticity of demand, or by scaling VaR according to the "time to escape;" i.e., the estimated number of days required for orderly liquidation of the position

d. Traditional functions of a commercial bank include "maturity transformation" and "liquidity transformation," but these functions tend to create balance sheet risk which, in turn, requires asset-liability management (ALM) techniques

707.3. Peter is a Risk Manager who is analyzing an equity position of 20,000 shares in an semi-liquid, non-public stock that has a current price of USD $50.00 per share. While Peter assumes the stock's daily expected return is zero, its estimated daily return volatility is 100 basis points (1.00%). The mean bid-ask spread is USD $0.40 (80 basis points). The bid-ask spread volatility is 20 basis points, and Peter will assume the volatility spread multiplier, k = 3.0. Finally, Peter will assume normally distributed arithmetic returns (he will not assume normally distributed geometric returns; aka, lognormal).

Which of the following is nearest to the one-day 95.0% confident normal liquidity-adjusted value at risk (LVaR) using the exogenous spread (aka, volatile spread) approach?

a. $16,450

b. $23,450

c. $29,170

d. $33,330

Answers here:

Last edited by a moderator: